ny paid family leave taxable

PFL is taxable to NY but not to NJ. State governments do not automatically withhold paid family leave federal tax from an employees PFL benefits.

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

NYSIF must provide insurance to any employer seeking coverage regardless of the employers.

. NYSIF is a not-for-profit agency of the State of New York that offers workers compensation New York State disability benefits and Paid Family Leave insurance. No deductions for PFL are taken from a businesses tax contributions. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax Reference link Say Thanks by clicking the thumb icon in a post Mark the post that answers your question by clicking on Mark as Best Answer 1 Reply. Pursuant to the Department of Tax Notice No. Ask Independently Verified Business Tax CPAs Online.

Employee-paid premiums should be deducted post-tax not pre-tax. Requirements for other types of employers are. New York States Department of Taxation and Finance released guidance regarding the tax implications of New York Paid Family Leave PFL the benefits of which take effect on January 1 2018.

New York State Paid Family Leave. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Taxes will not automatically be withheld from benefits but employees can request voluntary tax withholding.

Employers may collect the cost of Paid Family Leave through payroll deductions. And you would not be able to claim a credit for NY tax paid on PFL. Paid Family Leave provides eligible employees job-protected paid time off to.

In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current. 1 Obtain Paid Family Leave coverage.

Get Tax Lein Info You Can Trust. Average weekly wage of 145017. The maximum annual contribution is 42371.

They are however reportable as income for IRS and NYS tax purposes. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Use the calculator below to view an estimate of your deduction.

The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. N-17-12 PDF Paid Family Leave benefits are taxable. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

Ad 247 Access to Reliable Income Tax Info. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. However an employee can request to have income taxes withheld by filing Form W-4V.

2 Collect employee contributions to pay for their coverage. 2022 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave.

Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. As PFL premiums are funded through employee payroll deductions the Department has reviewed the tax treatment of these contributions along with.

The maximum 2021 annual contribution will be 38534 up from 19672 for 2020. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

Talk to Certified Business Tax Experts Online. It is a separate and distinct entity from the New York State Workers Compensation Board. The maximum weekly benefit for 2021 is 97161.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Regardless of how premiums are paid benefits paid to employees will be taxable non-wage income that must be included in federal gross income. However the amount should not show up on your NJ resident tax return.

Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or. As a result you will be taxed on PFL on your nonresident NY income tax return. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

In 2022 these deductions are capped at the annual maximum of 42371. This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage.

New York paid family leave benefits are taxable contributions must be made on after-tax basis After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program. Ad NY Paid Sick Leave Law More Fillable Forms Register and Subscribe Now. The weekly PFL benefit is capped at 67 of the New York State average weekly wage which is 97161.

Passer au contenu principal Connexion. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

Taxes will not automatically be withheld from benefits. Ad Download Or Email DE 2501F More Fillable Forms Register and Subscribe Now. Employees can request voluntary tax withholding.

This is 9675 more than the maximum weekly benefit for 2021. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

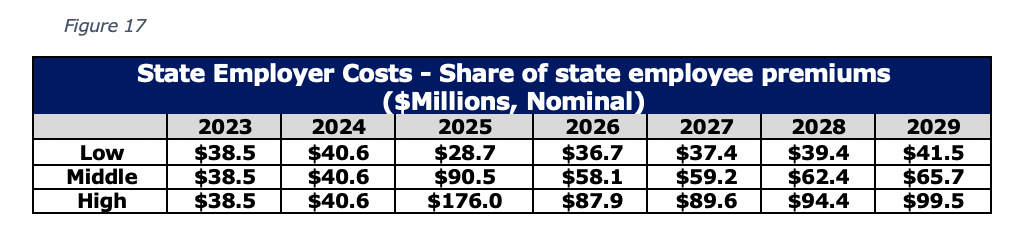

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

Standard Security Life Insurance Company Paid Family Leave

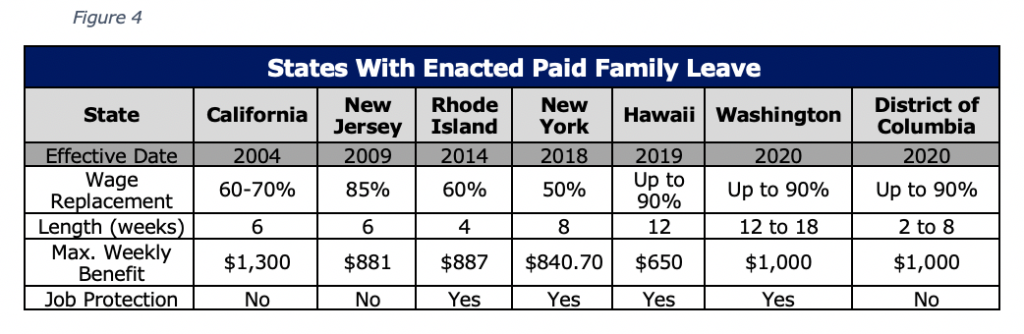

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

1099 G Tax Form Department Of Labor

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

Solved I Received State Disability From New Jersey Is That Taxable I Do Not Have A 1099 G I Have A Form W 2 With Money On Number One For Wages

Is Workers Comp Taxable Workers Comp Taxes

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

Confused About How To Claim Lta Here S Everything You Need To Know

Irs Guidance On Claiming Refundable Cobra Premium Subsidy Tax Credit

Standard Security Life Insurance Company Paid Family Leave

New Paid Family Leave Rate For 2022 Kbm Management

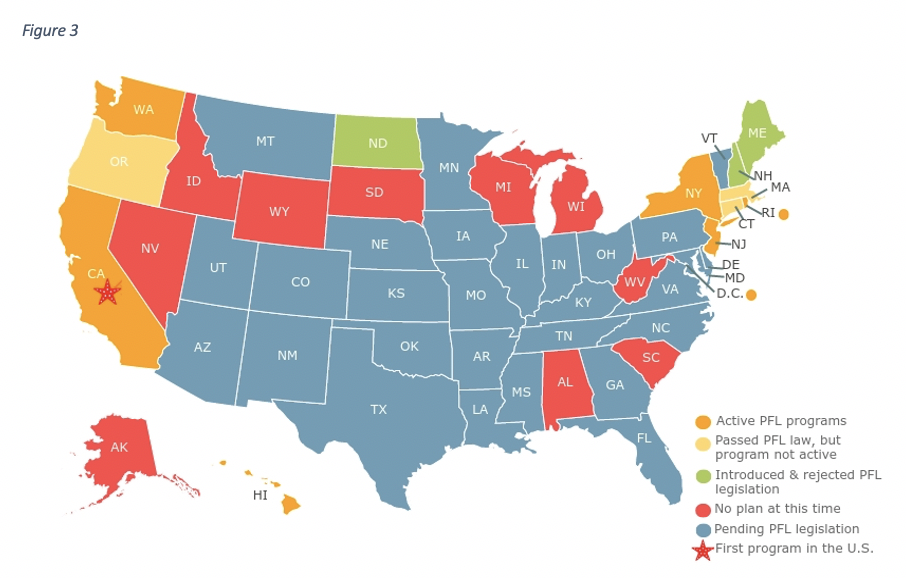

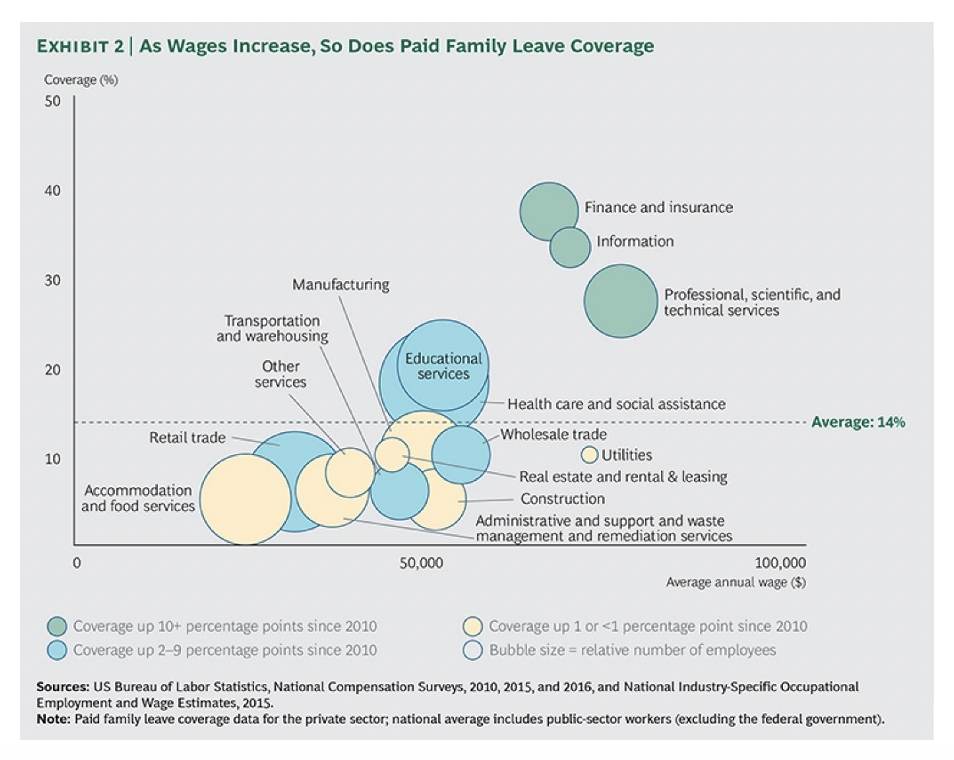

The Importance Of Paid Leave For Caregivers Center For American Progress