tax loss harvesting canada

Any DIY investor with a discount brokerage account can do their own tax loss harvesting however keeping track of everything on your own can be tough. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio.

. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. Rebalancing helps realign your asset allocation for a balance of. Connect With a Fidelity Advisor Today.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. If the amount of losses. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability. Its a strategy thats applicable only on taxable investment. You can simply sell any amount of losing positions to offset the capital gains in your winning positions.

You have until two trading days before the end of the year to sell assets to qualify for tax-loss harvesting however it is. Getting started with tax-loss harvesting. Tax loss harvesting is a method of reducing your taxes on capital gains realized from the sale of certain investments.

Ad Make Tax-Smart Investing Part of Your Tax Planning. This rule states that if an investor buys back the same security within 30 days of sale the tax. At the most basic level tax-loss harvesting involves selling a poorly-performing investment and reinvesting that money into another.

A capital loss can be used to offset a capital gain within a non-registered account. How Much Can You Save with Tax-Loss Harvesting. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket.

In fact you can. Tax-Loss Selling Made Crystal Clear. Tax Loss Harvesting and Muni Bonds.

Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered. How Tax-Loss Harvesting Works. It is typically used to limit the recognition of short-term capital gains.

Well the solution is quite simple. This maneuver is known as tax-loss harvesting or tax loss selling. You can then use these losses to.

It offers a tremendous amount of. As an example suppose you invest 100000 in a Canadian equity ETF and then the value declines to 90000. The funds are then used to purchase a comparable.

Tax-loss harvesting involves using realized losses on some investments to offset capital gains on others within an investors taxable accounts. David Hammer head of municipal bond portfolio management and John Nersesian head of advisor education discuss todays muni. One consideration for investors when employing tax-loss harvesting is the superficial loss rule.

Connect With a Fidelity Advisor Today. He says tax loss harvesting is available to clients who qualify for the Wealthsimple Black or Wealthsimple Generation premium service levels by having net deposits.

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Tax Loss Selling Using Canadian Listed Etfs To Defer Taxes On Capital Gains 2019 Pwl Capital

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

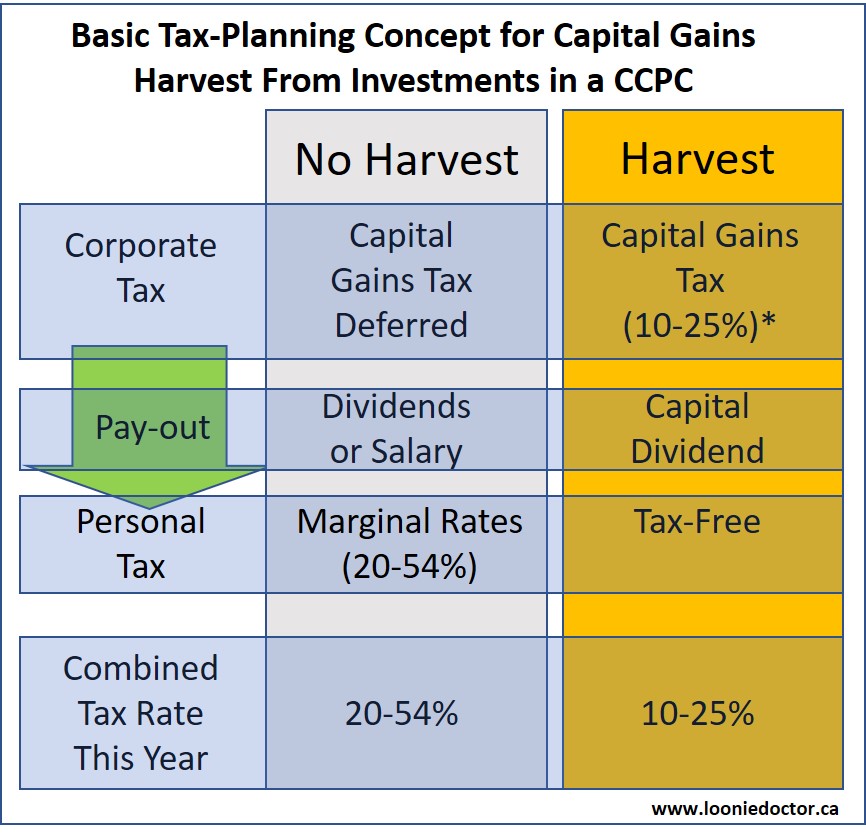

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

How To Use Tax Loss Harvesting To Boost Your Portfolio

Turning Losses Into Tax Advantages

How To Use Tax Loss Harvesting To Boost Your Portfolio

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

What Is Tax Loss Harvesting Ticker Tape

Using Exchange Traded Funds In Tax Loss Planning

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

2022 Crypto Tax Loss Harvesting Guide Cointracker

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management